Published on 18/06/2025

Parliament has rejected a proposal by the Ministry of Finance to exempt Bujagali Electricity Limited from paying income tax for the next seven years. Instead, it granted a one-year extension to allow the Attorney General time to renegotiate what MPs described as unfair terms in the existing agreement between the Government and the company.

This decision was made on May 14, 2025, during the consideration of the Income Tax (Amendment) Bill, 2025. The bill had sought to amend Section 21(1) to extend Bujagali’s tax exemption until June 30, 2032, in line with the power purchase agreement (PPA) between the Government and the Bujagali Hydropower Project.

Presenting the report of the Finance Committee, Amos Kankunda (Rwampara County) urged Parliament to support the proposal, arguing that the exemption would align with the PPA, which runs up to 2032. “The Committee recommends that Bujagali Hydro Power Project be exempted from income tax for a period of seven years, as proposed in the Bill, to remain consistent with the agreement,” said Kankunda.

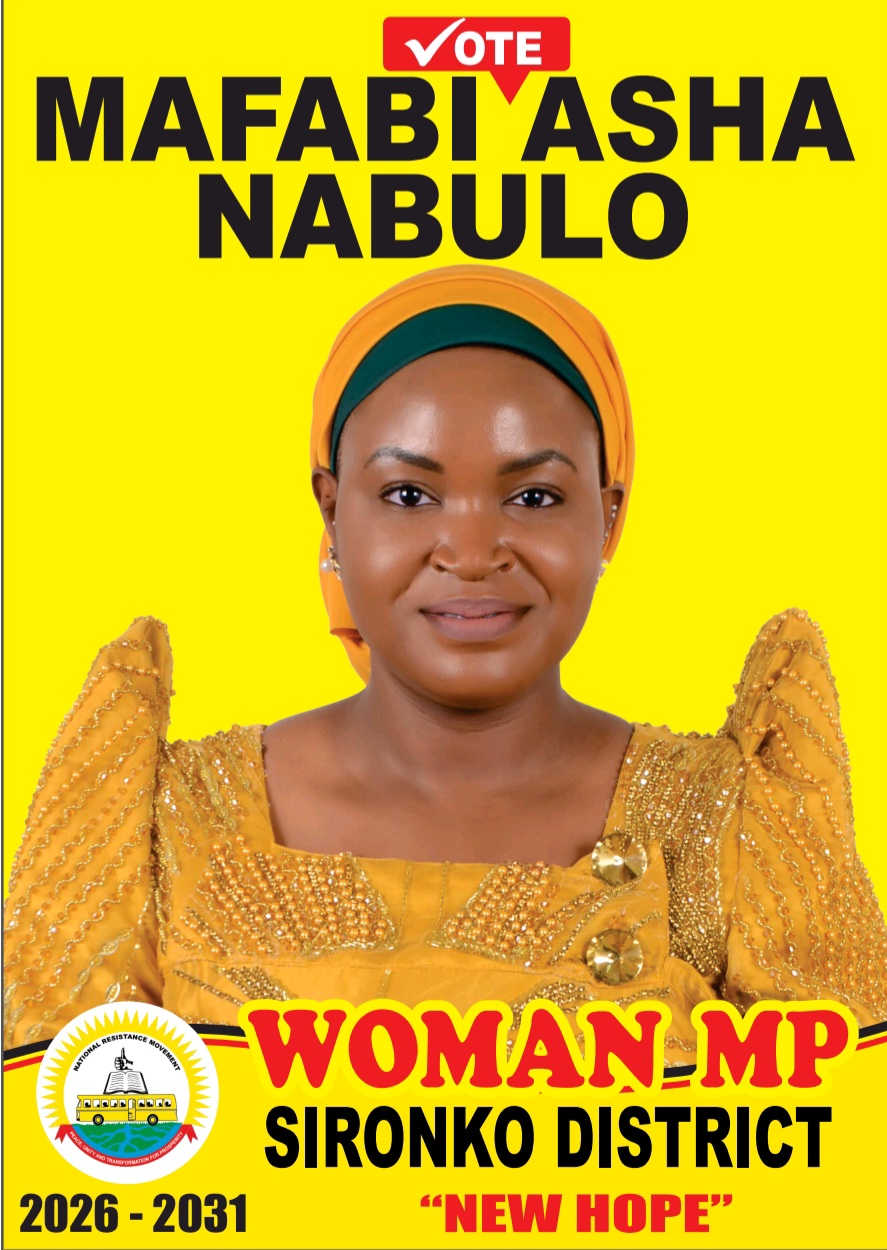

However, Kankunda’s recommendation was strongly opposed by several members of his own committee, including Ibrahim Ssemujju (Kira Municipality), Nandala Mafabi (Budadiri West), and Karim Masaba (Mbale Industrial Division), who dismissed the government’s request.

Ssemujju, the Shadow Minister for Finance, criticized what he called a piecemeal approach by Henry Musasizi, the Minister of State for Finance, to push through annual exemptions after Parliament had previously rejected a five-year extension in 2022. “He’s now resorting to annual amendments. This is the second time he’s bringing it within months. The reason Parliament previously refused was that the original purpose of the exemption had not been met,” said Ssemujju.

He rejected government’s claim that denying the exemption would increase electricity tariffs, pointing instead to continued abnormal profits by Bujagali despite previous exemptions. “By 2021, Bujagali had benefited from UGX 388 billion in tax exemptions, yet tariffs kept rising,” he noted.

Ssemujju also cited a report by the Auditor General which accused Bujagali of unethical conduct, such as wrongly claiming $114,114 for insurance costs that were supposed to be borne by its supplier. “The Auditor General recommended that Government acquire voting shares in Bujagali since it has no say in appointing directors or board representation,” he added.

The minority report, supported by Ssemujju and other MPs, recommended a comprehensive cost-benefit analysis before any further exemptions are granted. “We must assess the impact on tariffs, financial viability, and the broader economic benefit,” he emphasized.

Nandala Mafabi called the proposed seven-year extension “too long,” warning it would tie the hands of the incoming 12th Parliament. “We should not allow Bujagali any further exemptions. Instead, they should remit their excess profits to the Consolidated Fund,” said Mafabi, urging the Attorney General to review the agreement immediately.

Jonathan Odur (Erute South) echoed similar concerns, accusing Parliament of facilitating capital flight under the guise of investment agreements. “Let us restore respect for this House. We must not allow those flying private jets to evade taxes while ordinary Ugandans are burdened with new taxes,” he said.

Odur also warned that granting such a long exemption would be disrespectful to the next Parliament. “This decision must be left to the 12th Parliament. We should not act like we’ve forgotten our past resolutions,” he added.

Karim Masaba supported limiting the exemption to June 30, 2026, arguing that the next Parliament should have the opportunity to reassess the situation. Felix Okot (Dokolo South) proposed a compromise of a one-year exemption to allow time for renegotiations, cautioning against making long-term commitments without progress.

Despite the opposition, Minister Musasizi pleaded with Parliament to consider at least a three-year extension. “We are tired of coming back every year. That’s why we asked for seven years,” he said.

However, the Attorney General, Kiryowa Kiwanuka, was non-committal on whether renegotiations would take place. “It takes two to negotiate. Parliament can direct it, but if the other party refuses, there will be no renegotiation,” he said.

On the question of tariff impact, Kiryowa stated, “My role is to interpret the contract. I don’t know what the final tariff will be, but if tax is not waived, it will be added.”

He also revealed that despite earlier parliamentary recommendations to recover $348 million from Bujagali due to inflated calculations, he had not yet received legal instructions to pursue the case. “We need to appreciate the consequences of our decisions,” he cautioned.

In the end, Parliament opted for a one-year extension to give Government time to renegotiate the contract with Bujagali, with many MPs insisting that any further exemptions must be based on a thorough analysis and transparent public interest justifications.