The dispute between Kenya and Uganda over the importation of Ugandan petroleum products has escalated to the corridors of the East African Court of Justice (EACJ).

Uganda has filed a lawsuit against Kenya challenging its refusal to grant access to the Kenya Pipeline Company (KPC) infrastructure for the transportation of refined petroleum products from the Mombasa port to Uganda, as directed by Uganda’s Cabinet.

In its legal action, Uganda alleges that Kenya is obstructing its entity, the Uganda National Oil Company (UNOC), from operating as an Oil Marketing Company (OMC) in Kenya.

UNOC had initially planned to transport fuel products through the Kenya Pipeline but was instructed by the Energy and Petroleum Regulatory Authority (EPRA) to register as an oil marketer in Kenya. This registration would permit UNOC to import and export petroleum products through Kenya and utilize the country’s pipeline.

EPRA outlined various requirements for UNOC, including business registration certificates, identification documents for all directors, work permits, tax compliance certificates, proof of financial capability, evidence of operating licensed retail stations, and running a licensed depot with a turnover of USD 10 million over the last three years.

UNOC struggled to fulfill these requirements, arguing that as a fully State-owned company in Uganda, it intended only to transport products through Kenya without conducting business in the country.

Seeking exemption, UNOC’s case reached the Machakos High Court on November 7, 2023, leading to conservatory orders against granting any exemptions to UNOC.

Uganda, in its case at the East African Court of Justice, holds Kenya accountable for delays in granting exemptions. It aims to have EPRA’s licensing protocols for UNOC declared irrelevant, irrational, and illegal.

The court documents accuse Kenya of violating the East African Community Treaty by restraining EPRA from issuing an OMC license to Uganda.

Uganda seeks a declaration that it does not require a license from EPRA to access the Kenya Pipeline Company’s systems and transport petrol from Mombasa to Uganda.

Uganda also demands unconditional treatment of UNOC as a service supplier, no less favorable than other suppliers, and a permanent injunction against Kenya imposing unrealistic restrictions on UNOC’s access to the KPC.

While awaiting the EACJ’s decision, Uganda plans to cease buying fuel from Kenyan OMCs. Instead, it has entered a five-year contract with an Arab company to exclusively supply its fuel needs.

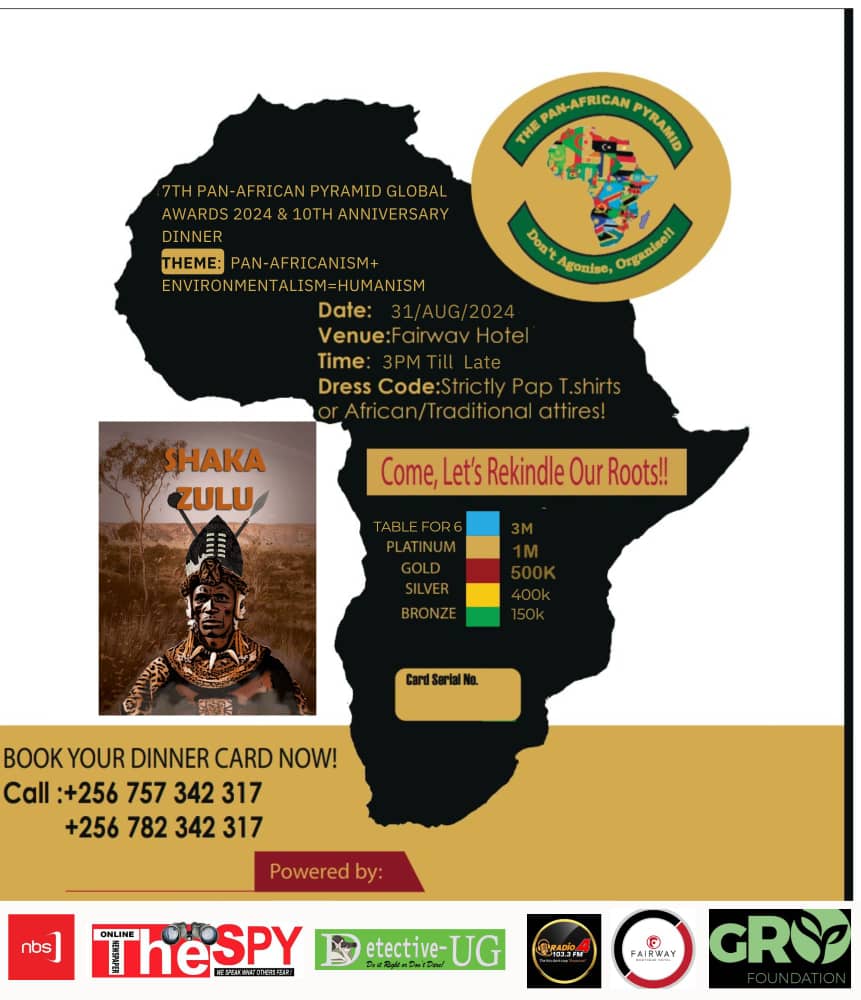

ANNUAL SALES

The requirements include proof of annual sales of 6.6 million litres of super petrol, diesel and kerosene, ownership of a licensed petroleum depot and at least five retail stations locally.

UNOC says that it complied with other requirements such as registering a branch in Kenya under protest as it raced to ensure that Uganda’s deal to directly buy fuel takes off smoothly.

The continued impasse raises questions on the state of the diplomatic relations between Kampala and Nairobi, given that this is the first time that countries have dragged each other to the regional court.

“Will this be the new trend now? Do the presidents talk to each other? What are the ramifications on the wider East African Community integration process?” posed an expert who sought anonymity.

Uganda will from this month start buying fuel directly from Vitol Bahrain, following a fall-out triggered by Kenya’s decision to enter into a government-backed deal with three Gulf oil majors.

With Kenya dragging its feet in granting UNOC a local licence, Uganda has also been in talks with Tanzania to use the Port of Dar es Salaam to handle the fuel imports.

But given KPC’s superior network compared to the facilities in Tanzania, Uganda has gone all out to ensure that Kenya grants UNOC the licence.

GLOBAL MARKET

“In order to implement the policy (decision by Uganda to directly buy fuel in the global market), it is necessary for the Republic of Uganda, through UNOC, to transport petroleum products through the Republic of Kenya under the infrastructure of KPC,” Uganda’s Attorney-General adds in the court papers.

Uganda imports an average of 2.5 billion litres of petroleum annually valued at $2 billion (Ksh302.34 billion), with KPC handling at least 90 percent of the cargoes.

A shift to the Port of Dar es Salaam would have significantly hurt KPC’s revenues given that Uganda is the single biggest market for the transit market imported through Kenya.

The shift would have also denied Kenya Revenue Authority taxes from management fees that local oil firms charge their Ugandan counterparts for handling transit fuel.

The impasse also amplifies the spat between the two countries less than two months after President Museveni accused Kenyan middlemen of being behind the high pump prices in Kampala even as global prices of the commodity continue to fall.

In November last year, Mr Museveni said that pump prices in Kampala were inflated by up to 59 percent in the wake of the deal that Kenya signed with Saudi Aramco, Abu Dhabi National Oil Corporation and Emirates National Oil Company.

A litre of super petrol is currently going for $1.44 in Uganda compared to $1.37 in Kenya while a litre of diesel is retailing at $1.38 in Kampala compared to $1.33 in Nairobi.

Uganda has the costliest fuel in the region and bets that directly buying the commodity would help lower prices.